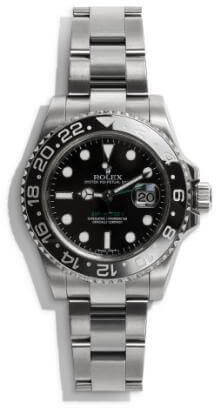

Pawn Your Luxury Watch

25 July 2023

Do you want to pawn or loan against your luxury watch? A pawnbroker is a great way to release liquidity from your luxury assets. Pawnbrokers have long been a valuable resource for individuals seeking quick access to cash without the need for credit checks or lengthy loan applications. London, with its rich history and vibrant financial hub, boasts some of the best pawnbrokers in the UK.

In this article, we will delve into the top pawnbrokers in London, explore the assets they accept, and provide a comprehensive guide for pawning luxury watches.

Luxury Watches and Assets Accepted by typical London Pawnbroker:

While luxury watches are highly sought after by pawnbrokers, London’s top establishments often accept a wide range of valuable assets. These may include fine jewelry, high end cars, precious metals, diamonds, luxury handbags, antique items, collectibles, and even fine art. Each pawnbroker has its own expertise and preferences, so it is crucial to research and find a pawnbroker specializing in the asset you wish to pawn. At Eldens, we are able to write loans on all of the assets listed above.

Pawning a Luxury Watch

Research reputable pawnbrokers: Look for well-established pawnbrokers with positive reviews and a track record of fair dealings in the luxury watch market. Consider factors such as experience, reputation, interest rates, and loan terms.

Appraisal and valuation: Visit the pawnbroker with your luxury watch to undergo an appraisal. Knowledgeable professionals will assess the watch’s condition, brand, model, age, rarity, and market demand to determine its value. Ensure the pawnbroker is transparent about their valuation process.

Negotiate loan terms: Once your watch has been appraised, the pawnbroker will offer a loan amount based on its value. Negotiate loan terms, including the interest rate, repayment period, and any additional fees. Be sure to understand the terms thoroughly before proceeding.

Secure the loan: If you accept the pawnbroker’s offer, you will need to provide the necessary identification and complete the required paperwork. Ensure you receive a written agreement detailing the loan terms, including the loan amount, interest rate, and repayment schedule.

Safekeeping of your luxury asset: Most pawnbrokers will store your luxury watch securely in their facilities for the duration of the loan. Confirm that the pawnbroker has appropriate insurance coverage and security measures to protect your asset. A reputable pawnbroker will have a good storage solution, such as a Harrods safety deposit box.

Repayment and collection: Repay the loan within the agreed-upon timeframe to avoid default. Once the loan, including any accrued interest, is settled, you can reclaim your luxury watch.

London’s best pawnbrokers provide an excellent solution for individuals in need of quick funds while retaining ownership of their valuable assets. When pawning a luxury watch, research reputable pawnbrokers, undergo a thorough appraisal

Are there different types of pawnbrokers?

Yes, there are different types of pawnbrokers that cater to various needs and market segments.

Here are some common types:

Traditional Pawnbrokers: These are the classic brick-and-mortar establishments that have been around for centuries. Traditional pawnbrokers accept a wide range of items as collateral, including jewellery, electronics, musical instruments, and more. They provide short-term loans and typically operate from physical storefronts.

Luxury Asset Pawnbrokers: These specialised pawnbrokers focus on high-value luxury assets such as fine jewellery, luxury watches, designer handbags, rare artwork, and collectibles. They have in-depth knowledge of luxury markets, offer expert appraisals, and provide larger loan amounts for valuable items.

Online Pawnbrokers: With the advent of technology, online pawnbrokers have emerged as a convenient alternative. These platforms allow individuals to pawn their items from the comfort of their homes. They offer digital appraisals, secure shipping options, and flexible loan terms.

Car lenders: Car lenders specialise in lending money against vehicles such as cars, motorcycles, boats, or RVs. They assess the value of the vehicle and provide loans based on its worth. The vehicle serves as collateral, and borrowers can typically continue using their vehicles during the loan term.

Jewellery Pawnbrokers: Some pawnbrokers focus primarily on Jewellery, including gold, silver, diamonds, gemstones, and fine watches. These specialised establishments have expert gemologists who assess the quality and value of Jewellery items and offer loans based on their appraisal.

Boutique Pawnbrokers: Boutique pawnbrokers cater to a niche market, often focusing on high-end clientele. They offer personalised service, private consultations, and discrete transactions. These establishments prioritise confidentiality and may specialise in luxury assets, antiques, or unique collectibles. COIN operate in this market segment.

It’s important to note that while the basic concept of providing collateral-based loans remains the same across different types of pawnbrokers, the specific assets accepted and the level of expertise can vary. When choosing a pawnbroker, consider your needs, the type of asset you wish to pawn, and the reputation and expertise of the pawnbroker in that particular field.

Pawnbroking Case Study

Watch brand: Rolex Daytona

Model: Yellow Gold, 6265

Open market value: £80,000

Loan value: £40,000

Interest per month: 3.99%

Term: 6 months